“I’ll just keep it safe in the bank.”

It sounds smart. It feels responsible. But it might be the costliest decision you’re making without even realizing it.

Inflation is often called the “silent tax” — and for good reason. It doesn’t show up on your bank statement, but it reduces the real value of your money every day.

In an economy where inflation quietly eats away your purchasing power, keeping money in a low-interest savings account is like storing water in a leaky bucket. You didn’t see it at first — but the damage is very real.

In this article, we break down why traditional banking is failing to savers, how €100 from a few years ago may be worth much less today, and what you should be doing instead.

Why The “Safety” of Banks May be an Illusion

Banks offer psychological comfort: your money is accessible, insured, and appears stable. But stable isn’t the same as protected. In real terms, the value of your savings is shrinking — slowly, silently, and surely.

This is especially dangerous if you:

Are saving for retirement

Rely on cash reserves for emergencies

Are keeping large amounts idle while “waiting for the right time to invest”

Your bank is not your wealth strategy. It’s a storage unit. And even worse: it charges rent on your money via inflation.

Real-World Illustration: €100 Over Time

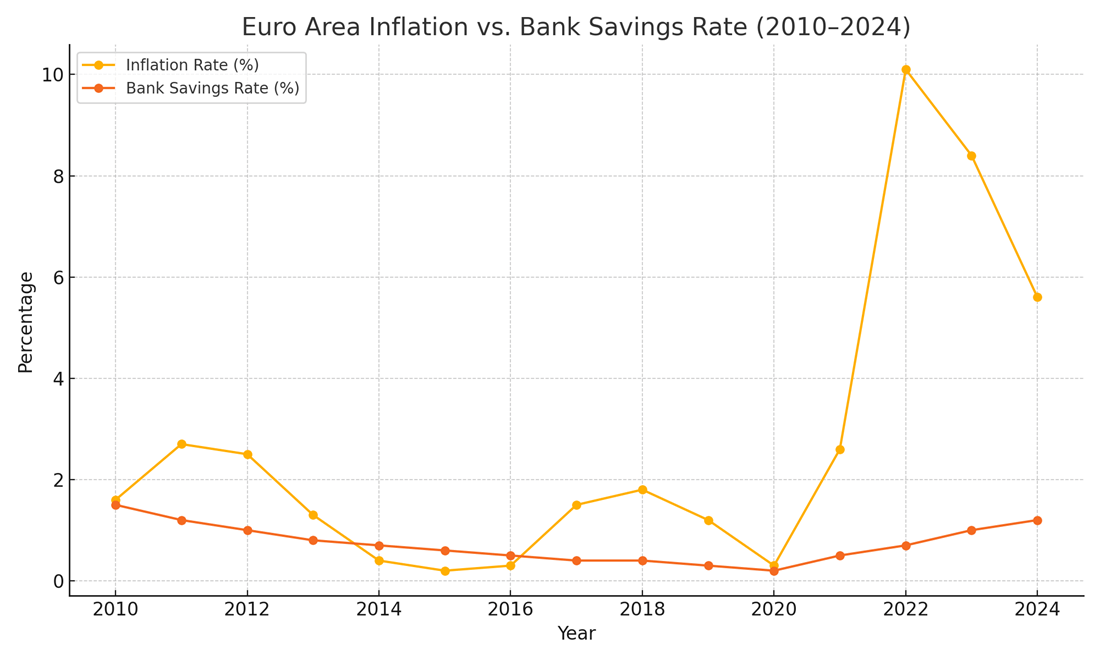

Let’s visualize what happens when €100 is left in a savings account, earning almost no interest, while inflation marches on. The below graph shows the inflation rate is the EU in the past 15 years compared to the rates you earn from deposits:

Chart 1: Euro Area Inflation vs. Bank Savings Rates (2010–2024)

Over the past 15 years, savings account interest rates in the euro area have consistently lagged behind inflation. This gap widened significantly after 2020, when inflation surged while deposit rates remained near zero.

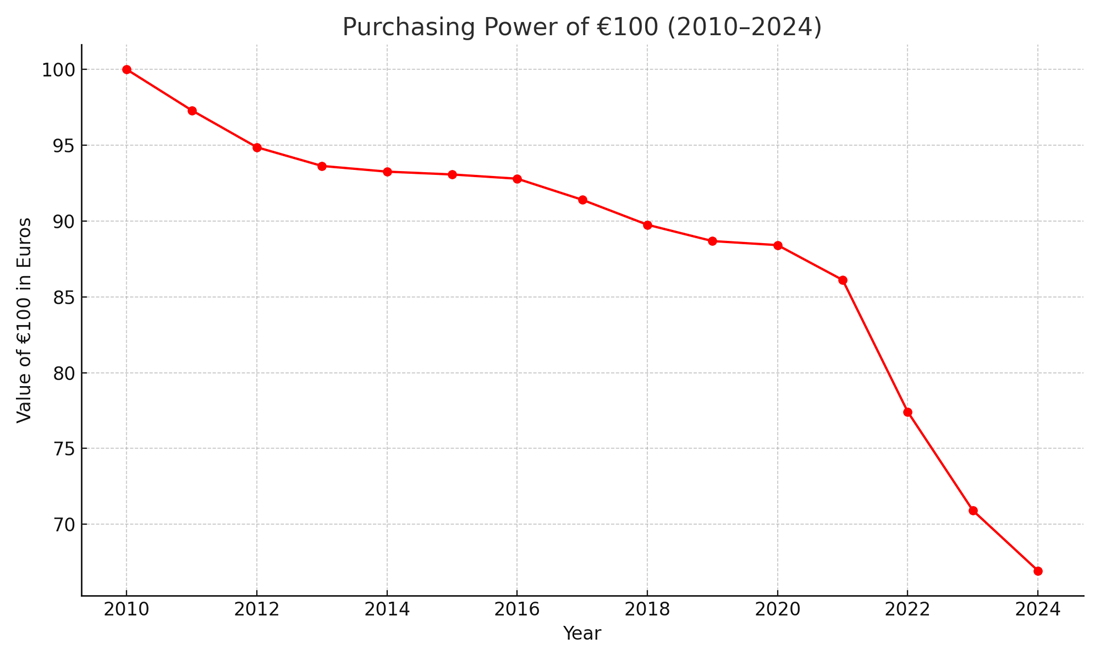

Chart 2: Real Value of €100 (2010–2024)

The second chart shows the impact of this mismatch on the real purchasing power of your money. While the nominal value remains €100, its real value—what you can actually buy with it—has steadily declined. By 2024, the €100 you saved in 2010 has lost around 35% of its value, leaving you with the equivalent of just €65 in today’s terms.

This decline in real value has real-world consequences. What truly matters isn’t the number on your bank statement (the nominal value), but what that money can buy (the real value).

For example, if the price of a pizza doubles from €10 to €20, your €100 now buys just 5 pizzas instead of 10. The purchasing power of your money has been cut in half—even though the nominal amount hasn’t changed.

What Can You Do To Protect yourself?

Your money should work as hard as you do. Here are some smarter ways to preserve and grow your capital:

Invest in a Diversified Portfolio of Assets

Consider building a well-diversified portfolio using cost-efficient ETFs that span a broad range of asset classes—such as equities, bonds, commodities, and gold. This approach helps spread risk, enhance long-term returns, and protect your wealth from inflation.Own Real Assets

Real assets, commodities, and gold often perform well during inflationary cycles.Use Money Market Funds or Short-Term Bonds/Fixed Income ETFs

These offer better interest than banks with manageable risk.Educate Yourself

Understanding risk, compounding, and market behavior is your ultimate protection.

You don’t have to become a Wall Street wizard — just stop letting your money bleed value without a plan.

Final Thought: Inaction Is a Liability

In uncertain times, many default to “waiting.” But waiting while inflation climbs is still a decision — and an expensive one. Cash isn’t king if it’s locked in a kingdom that’s losing value.

If you’re serious about preserving wealth, then it’s time to go beyond the bank.

Looking for Guidance?

We help clients protect their capital, beat inflation, and build long-term strategies with transparent fees and personalized support.

📩 Contact us today. Your future self will thank you.