"Printing money is the last resort of desperate governments when all other policies have failed." George Osborne

Currencies rarely collapse with a bang. They erode quietly, year by year, until the damage is undeniable.

Wondering why your money buys less every year? The euro and the US dollar, the two most powerful fiat currencies on earth, have not lost value overnight. They have lost real value gradually, through policy choices, debt accumulation, and monetary expansion.

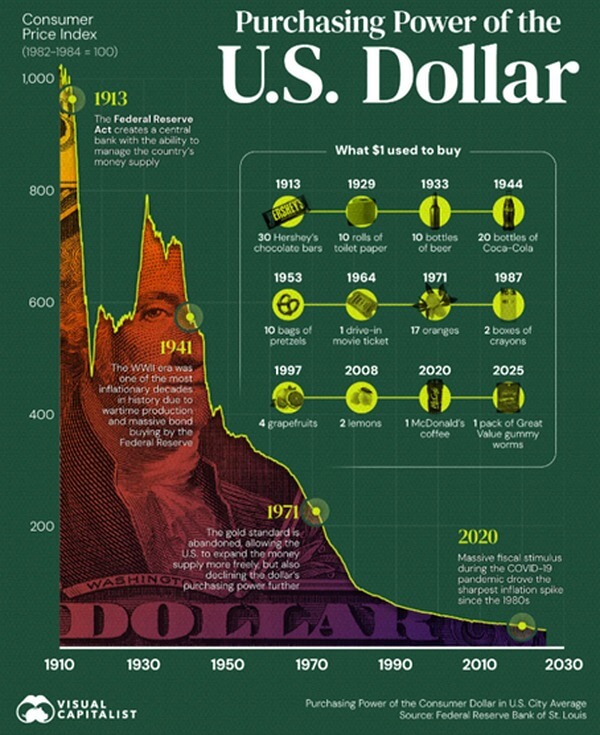

Measured against gold, “money” that cannot be printed, the loss of real value in both the EUR and USD is staggering. In 1944, one dollar bought twenty bottles of coca cola. Today, it barely buys a pack of bargain gummy bears.

Source: Visual Capitalist

Fiat Money’s Hidden Weakness

The euro and the dollar are not backed by tangible assets. Their value rests on confidence, regulation, and central bank discipline. Over the past five decades, that discipline has steadily weakened.

Since the US abandoned the gold standard in 1971, the dollar has become a pure fiat currency, printable at will. The euro, born in 1999, inherited the same structural flaw. What followed was predictable:

Persistent easy monetary policies

Growing sovereign debt

Financial crises resolved through money printing

Inflation “under control” on paper, unaffordable in real life

The result is not hyperinflation, it is slow confiscation of your purchasing power, what you can really buy with your money.

The Gold Benchmark: An Uncomfortable Truth

Gold does not generate yield. It does not innovate. It does not grow GDP. Yet it has performed one function for thousands of years: preserving value.

That makes it a brutally honest measuring stick.

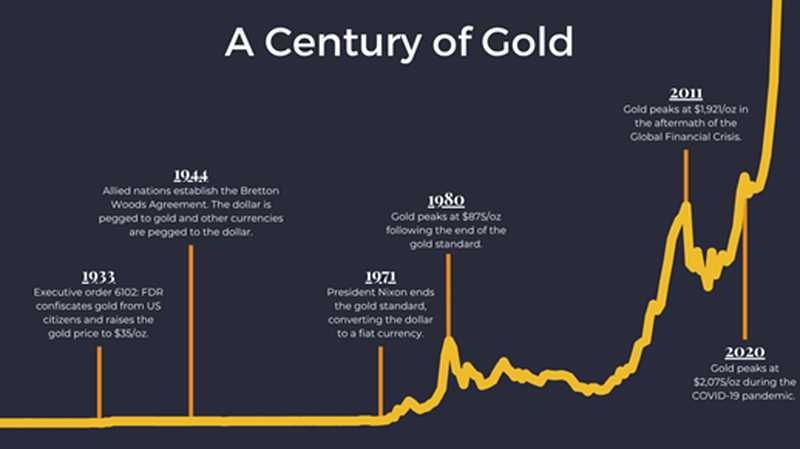

The US Dollar vs Gold

In 1971, gold was fixed at $35 per ounce

January 2026, gold traded above $4,500 per ounce

Source: Vaulted

That is not gold “getting stronger.” That is the dollar losing over 99% of its purchasing power.

Put differently:

What $35 could buy in 1971 now requires more than $4,500.

The Euro vs Gold

At the euro’s launch in 1999, gold traded near €250 per ounce

In January 2026, gold traded well above €4,000 per ounce

In just over two decades, the euro has lost more than 90% of its value relative to gold, despite being managed by a central bank explicitly mandated to ensure price stability.

Why Official Inflation Numbers Miss the Point

Governments and central banks point to inflation statistics to claim success. But consumer price indices, and the baskets of goods on which they are calculated, are moving targets:

Baskets of goods change

Weightings shift

Asset inflation is excluded

Monetary dilution is ignored

Gold, by contrast, requires no adjustments. It reflects the cumulative effect of monetary expansion in a single number.

Gold doesn’t lie, it simply prices currencies honestly.

Debt Is the Real Driver

The true enemy of fiat currency value is not consumer inflation, it is debt.

Both the US and the eurozone operate under debt loads that cannot be repaid in real terms. This creates a structural incentive to:

Inflate away debt, repaying you with money worth less in the future

Suppress real interest rates

Devalue currency slowly rather than default openly

Gold rises not only because of fear, but because real, hard math eventually wins.

Purchasing Power: The Everyday Reality

The consequences are visible in daily life:

Housing prices detached from wages

Savings earning less than inflation

Assets and stock prices outperforming salaries

Cash becoming a devaluing asset

A generation ago, a single income could comfortably support a household. Today, dual incomes struggle, not because productivity collapsed, but because money weakened.

Gold simply recorded the loss.

Respect, Not Just Value

Currencies also lose something less measurable but equally important: credibility.

When people realize that:

Long-term saving in cash is punished

Monetary rules change under stress

“Temporary” money printing measures become permanent

Trust erodes. Gold gains respect not through marketing, but through consistency.

The Inescapable Conclusion

Measured against gold, the verdict is clear:

The dollar has been systematically debased

The euro has followed the same path, only faster

Gold is increasing value without intervention, promises, or policy committees

Building Wealth in a World of Printable Money

If there is one clear lesson from the long-term decline of fiat currencies, it is this: building and preserving wealth requires diversification beyond assets that can be endlessly printed or created.

Stocks, bonds, and cash all exist within the same financial system. Real assets such as precious metals, by contrast, sit outside that system. They cannot be printed, legislated, or reprogrammed by central banks.

That does not make them easy investments.

Precious Metals: Powerful, but Not for the Faint of Heart

Gold has dramatically outperformed the euro and the dollar over the long run, but the journey has been anything but smooth.

Consider this reality check:

After peaking near $850 in 1980, gold entered a 20-year bear market

By 1999–2001, gold had fallen to around $250, a drawdown of roughly 70% in nominal terms

Adjusted for inflation, the loss in real purchasing power was even more severe

More recently:

From 2011 to 2015, gold declined by about 45%, even as monetary expansion continued

These episodes underline a critical truth:

Gold protects purchasing power over decades, not portfolios over months.

Volatility is the price paid for independence from fiat systems.

The Role of Real Assets in a Modern Portfolio

Precious metals are not a replacement for productive assets. They do not generate cash flow, dividends, or earnings growth. Their role is different, and essential:

To hedge against monetary dilution

To diversify systemic risk

To protect long-term purchasing power

To provide optionality in periods of financial stress

Used wisely, they complement traditional portfolios rather than compete with them.

You Can’t Save Your Way to Security in a World That Prints Money

If you want to live comfortably in the future, saving alone most likely will not be enough.

You must invest, and you must diversify intelligently. That means combining stocks and bonds with measured exposure to real assets that cannot be printed, managed with discipline, patience, and strict risk controls.

In a world where money is created by keystroke, true wealth belongs to those who prepare for what cannot be printed away.

Important Disclaimers: Numbers and illustrations are for educational purposes only and do not represent guarantees of future results. Past performance is not indicative of future returns. This is a marketing communication and does not constitute investment advice. The information and opinions expressed herein are solely those of the author. Investing involves risk - your capital is at risk.