For generations, banks have represented safety, trust, and financial security. Yet when it comes to investing, this perceived safety often comes at a steep—yet hidden—cost. While banks offer easy access to investment products and well-known advisors, many of these services are designed to benefit the bank far more than the investor.

In this article, we explore how traditional bank-distributed investment funds often erode long-term wealth through hidden fees, misaligned incentives, and structural inefficiencies. We’ll show why what seems “safe” could be quietly sabotaging your financial goals—and how you can protect yourself.

1. Understanding the Fee Structure: What You See Is Not What You Pay

At first glance, a bank investment fund may appear reasonable, often quoting a 1–2% annual management fee. However, this is only the surface.

Banks often embed several additional costs into their investment offerings:

Custodial fees for holding the assets.

Transaction fees applied internally on trades.

Entry or Exit fees on investments.

Lock-up periods or withdrawal penalties that restrict access to your funds or impose charges for early exit.

Currency conversion spreads when foreign assets are involved.

Cash management spreads, where banks earn significantly more on your cash than what they return to you.

These hidden charges may seem small individually—but they compound over time, quietly eating into your long-term returns.

2. Incentive Misalignment: Who Is the Advice Really For?

Bank investment advisors are typically incentivized to recommend products that generate the highest revenue for the institution, not necessarily those that best suit the client.

This practice is comparable to being treated by a doctor who’s paid by a pharmaceutical company—can you trust their prescription?

Below are some common issues we've observed in client portfolios previously managed by banks:

In-house funds and structured products are frequently promoted regardless of client suitability, as they tend to lack transparency and carry significantly higher embedded fees.

Advisors often steer clients toward higher-risk investments that generate greater fees—even when such products may not align with the client's risk profile.

Low-cost, independent ETFs are typically avoided, as they offer minimal commissions and do not benefit the bank’s revenue model.

Investment recommendations are often driven by internal sales targets, rather than by what best serves the client’s long-term objectives.

3. The Safety Illusion: Are Banks Truly the Safer Choice?

Most investors associate “big bank” with “low risk.” But in reality, the structure and incentives of bank-managed investments may expose clients to greater long-term risks—especially when transparency is lacking.

Here’s what clients often overlook:

In periods of market stress, banks prioritize their balance sheet and liquidity.

Many investors don’t understand the layered fees in their portfolios.

Bank-advised portfolios may lack independent oversight or diversified exposure.

True investment safety lies in alignment, transparency, and efficient costs—not simply in the institution's brand name.

4. Compounding the Problem: A Real-World Example

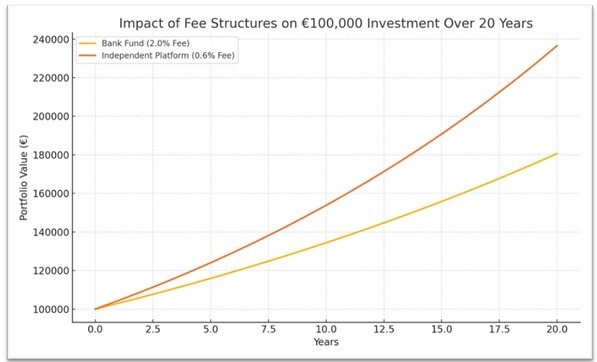

Let’s say two investors each contribute €100,000 into long-term portfolios that grow at 5% per year:

Scenario | Annual Fees | Portfolio Value After 20 Years |

Bank-Distributed Fund | 2.0% | €203,000 |

Independent Platform Fund | 0.6% | €265,000 |

That’s a €62,000 difference—not because of bad markets or poor strategy, but simply due to fees.

5. What Can You Do?

You don’t need to abandon banks completely—but you do need to ask the right questions and know exactly what you're paying for. Many investors unknowingly accept high costs in the name of “safety,” while better alternatives exist.

Here’s how to protect your capital and move toward smarter, more transparent investing:

Ask the bank representatives to confirm that the advice you’re receiving is truly independent—and not limited to in-house products or those that generate trail fees for the bank.

Ask the bank to disclose if they are paid any commissions or trail fees from the product they offer you.

Ask for full fee transparency — every layer, including management, custody, and hidden spreads.

Review your portfolio performance net of fees — not just the headline returns.

Compare traditional banks with independent advisors or low-cost platforms — the difference in costs can be significant over time.

Evaluate if your advisor is incentivized by commissions or truly working in your best interest.

Get a second opinion — an independent portfolio review can uncover unnecessary costs and risks.

In investing, what you don’t see often hurts you the most. Fee transparency, incentive alignment, and platform independence are not luxuries—they're necessities for building long-term wealth.

Final Thoughts

The perception of safety in bank investment products is often built on branding, not substance. Behind polished presentations and high-street credibility may lie a network of incentives and fees that silently erode your wealth.

By understanding the true cost of "safe" bank investments, you empower yourself to make more strategic, transparent, and aligned financial decisions—ones that genuinely serve your long-term goals.

🔍 Find an investment firm with clear, transparent fees and a client-first mindset.

📞 Want a second opinion on your current portfolio or fees? Contact Numisma today — our team is here to help you take control of your capital and your future.

-1280x720.jpg)