Prepare for Impact: Is the AI Hype Nearing Its Tipping Point?

A New Chapter in Tech — or a Familiar One?

Artificial Intelligence (AI) has been in development for decades, but only recently has it reached mainstream integration, thanks to massive advances in computing power, data availability, and algorithmic innovation. The current AI explosion—driven by breakthroughs in large language models and processing efficiency—has captivated the public and markets alike. This surge, however, is beginning to display some unsettling similarities to the dot-com bubble of the late 1990s.

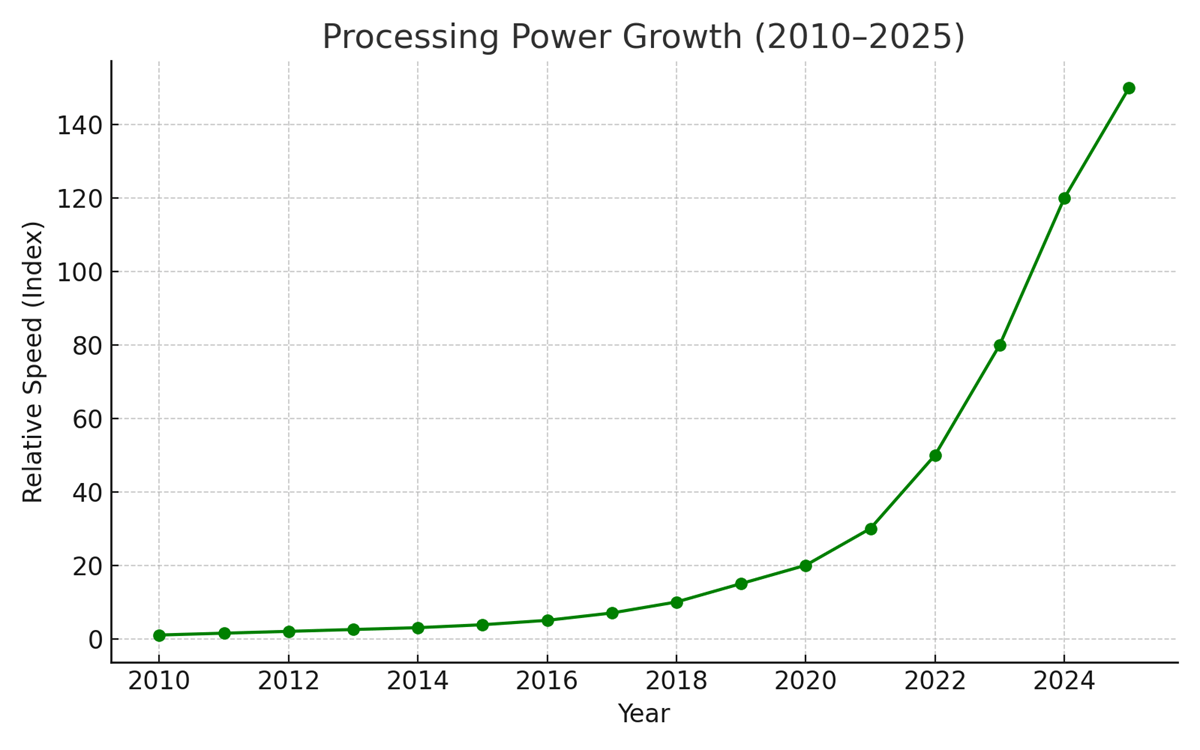

The chart below shows the significant increase in processing power over the last 15 years, enabling the current AI boom.

Artificial Inflation: The 2025 Buzz Cycle

Language models like ChatGPT, Claude, and Gemini are being integrated into nearly every aspect of modern business. AI is now assisting with writing, automation, coding, and analytics. At the same time, it's also disrupting job markets, leading to both fascination and concern.

Powering the Boom: AI’s Infrastructure Rush

The AI boom has fuelled a dramatic rise in demand for semiconductors and cloud infrastructure. Companies like NVIDIA have positioned themselves as the backbone of this revolution. NVIDIA’s graphics processing units (GPUs) are considered the new oil of the AI age, and their sales have surged dramatically as a result.

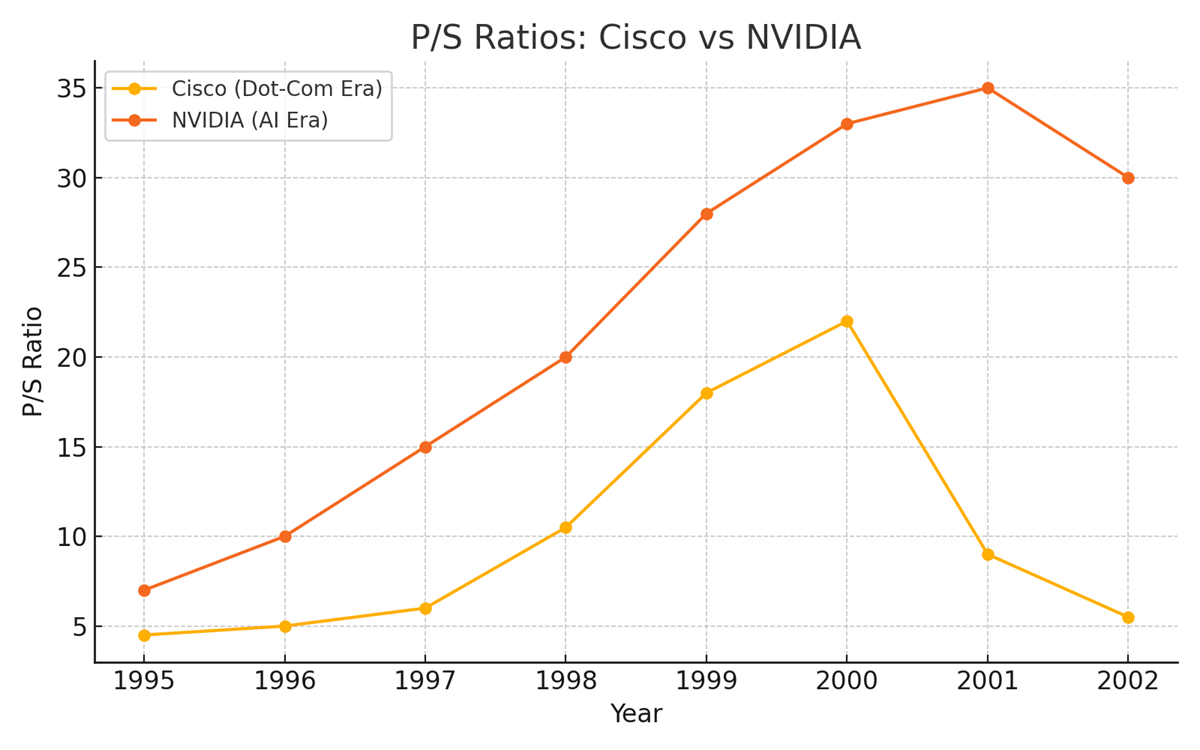

The chart below compares the Price-to-Sales (P/S) ratios of Cisco during the dot-com boom and NVIDIA during the current AI boom.

When the Numbers Stop Making Sense - Signs of Overvaluation

NVIDIA’s P/S ratio exceeded 35x in 2024, echoing the valuation extremes of dot-com leaders in 1999.

Some AI firms are engaging in circular revenue generation—investing in and purchasing services from one another—which can artificially inflate sales figures. This pattern is reminiscent of the dynamics seen during the dot-com era.

Companies with little or no profitable operations have achieved billion-dollar valuations simply by labelling themselves as “AI-first.”

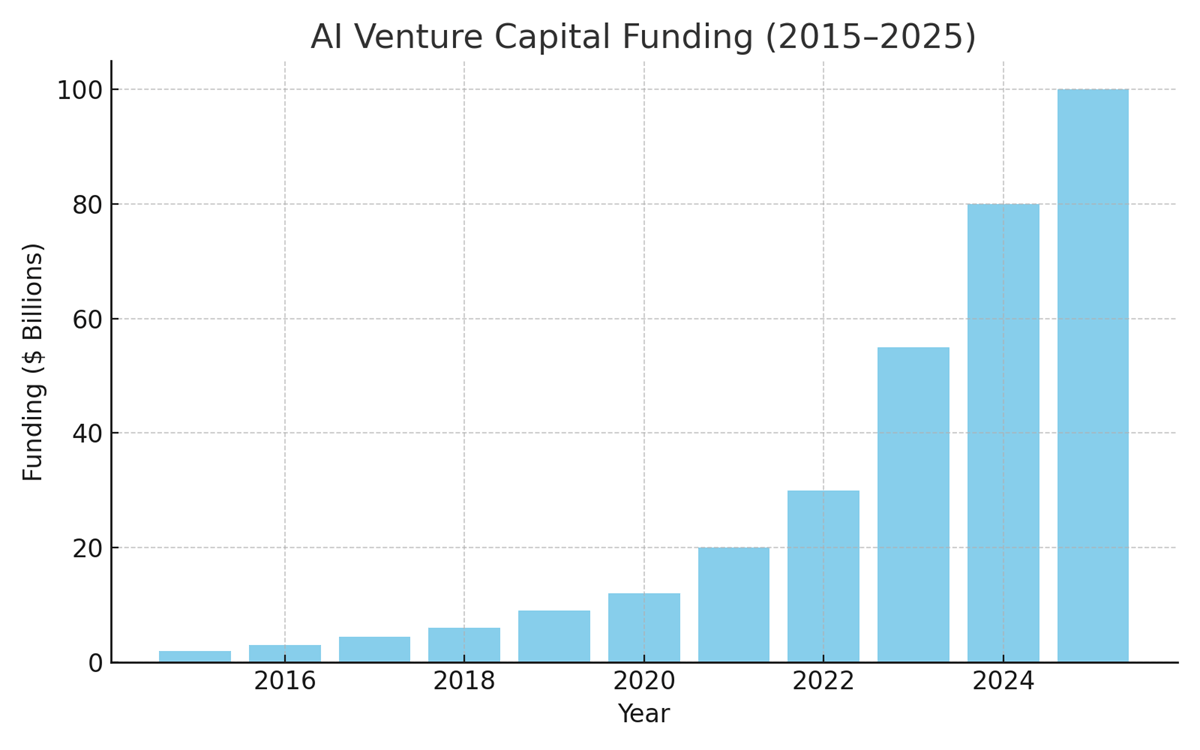

Record-Breaking Venture Capital Inflows

According to estimates, AI-focused start-ups received over $100 billion in venture capital in 2025—an all-time high. This mirrors the speculative capital inflows of the late 1990s, where money chased ideas more than business fundamentals.

The Psychology of Bubbles

FOMO (fear of missing out) is evident among retail investors and institutions alike. “AI-themed” ETFs, influencer-driven stock picks, and exponential share price moves are classic signs of speculative frenzy. A key psychological driver is the belief that AI will change everything—and quickly.

AI Use Cases: Reality vs. Hype

Genuine advancements: AI is automating customer service, drafting code, and enhancing creative workflows.

Problematic behaviour: Many firms market AI capabilities without the backend to support them, drawing regulatory scrutiny.

Regulatory and Economic Headwinds

Governments worldwide are developing rules to address data privacy, misinformation, and model transparency in AI. Economic tightening could also constrain AI investment, particularly for start-ups reliant on external capital.

The Hidden Costs of AI Expansion

Beyond their technical limitations, today’s AI systems come with significant social and environmental costs. Training large models requires enormous amounts of electricity, water, and computing infrastructure — a burden often omitted in industry narratives. Additionally, the development of AI systems relies heavily on a global labour force tasked with labelling data, frequently under low-wage and stressful conditions.

There are growing concerns about the displacement of workers in creative, service, and entry-level roles. Many fear that as these tools are integrated into workflows, they will push people out of sustainable careers. Efforts to humanize AI, such as chatbots claiming to understand users or provide companionship, may offer a placebo effect while actually deepening social isolation and increasing dependency on technology.

The Illusion of Intelligence - Code That Sounds Smart

Despite popular perception, leading AI systems today do not possess true intelligence or understanding. Some experts argue that language models simply predict what comes next in a sentence, functioning as advanced statistical tools rather than thinking machines. The perception of intelligence is a projection by the user rather than an inherent feature of the model. These systems operate by identifying and replicating patterns in language, not by developing actual insight or comprehension.

The concept of 'stochastic parrots' has been used to describe how language models mimic speech and writing using probabilities derived from vast training datasets. This metaphor illustrates how AI models generate plausible-looking content without reference to meaning or context, reinforcing the idea that the current generation of AI lacks genuine understanding.

Scepticism in the Face of Hype

While investors continue to pour billions into AI ventures, some critics caution that many of the claims made about these technologies are exaggerated. Rather than approaching the capabilities of true general intelligence, current models remain constrained statistical systems — more akin to advanced spreadsheets than sentient minds.

Geopolitical competition has further intensified AI development, often under narratives of national supremacy or existential urgency. However, these perspectives may obscure the need for balanced governance, ethical standards, and public accountability. Unchecked expansion of AI tools could risk entrenching biases, eroding professional standards, and reshaping social institutions without democratic oversight.

Final Thoughts

The recent AI boom bears striking resemblance to previous technology-driven bubbles, marked by inflated valuations, speculative investment, and overhyped promises. While artificial intelligence has introduced real innovations, its current capabilities remain bounded by statistical pattern recognition and lack true understanding. Investors, policymakers, and society must be cautious not to conflate automation with intelligence, nor to overlook the social, ethical, and environmental consequences tied to rapid AI deployment.

As history has shown, hype can outpace reality for years, but fundamentals eventually reassert themselves. The imperative now is to foster critical discourse, establish strong regulatory oversight, and avoid placing blind faith in tools we do not fully understand.

Prepare for impact?

As John Maynard Keynes famously said, “The market can stay irrational longer than you can remain solvent.” It’s a timely reminder to remain cautious—even when confidence runs high and expert opinions seem unanimous.

Market bubbles can persist far longer than expected, and no one holds a crystal ball to predict the precise moment they will burst. However, given the current pace of investment, inflated valuations, the widening gap between perception and actual capabilities, and the limited tangible revenues being generated by many “AI companies”, cautious investors may wish to take a more measured and prudent approach to the AI sector.

Sometimes, it may be better to leave a little money on the table than to be left holding the bag when the music stops.