For many conservative investors, buying a home, or even a rental property, feels safer than the stock market. You can see it, touch it, and live in it. Stocks, by contrast, seem like paper assets that rise and fall with the day’s headlines.

But when you step back and look at the data over decades, the picture is strikingly clear:

👉 Stocks have historically beaten real estate—by a wide margin—as a long-term investment.

The Numbers Don’t Lie

Stocks (S&P 500 total return): Since 1990, U.S. equities have delivered 10.6% annual returns (nominal), ~7.9% after inflation. That means an investment of $100,000 in 1990 grew by 34 times, to over $3,400,000 by 2024.

Housing (S&P CoreLogic Case-Shiller U.S national home prices): Over the same period, home prices grew only about 4.3% per year nominal, and after inflation, close to 1.6% real growth annually. In other words, your house has barely outpaced inflation. $100,000 tied up in home values in 1990 grew by little over 4 times to less than $430,000 by 2024.

In Europe, results are even more striking. Take the UK, one of Europe’s most popular real estate markets for investments:

Stocks (FTSE All Shares TR): Since 1990, U.K. equities have delivered 7.6% annual returns (nominal), ~4.9% after inflation. That means an investment of £100,000 in 1990 grew by 13 times, to over £1,300,000 by 2024.

Housing (UK Nationwide House Price Index): Over the same period, home prices grew only about 1.6% per year nominal, and after inflation, they lost -1.7% annually. In other words, houses in the UK have lost value in real terms, after inflation. £100,000 tied up in home values in 1990 grew by 1.46 times to about £146,000 by 2024.

The takeaway: While stocks multiplied wealth by hundreds, housing values barely outpaced the cost of groceries and gas.

Why Stocks Pull Ahead

Compounding on Autopilot

Stocks compound naturally— dividends reinvest, earnings grow, and buybacks boost per-share value. Real estate appreciation compounds only through leverage, and even then, ongoing costs drag it down.Innovation & Productivity Growth

Stocks can capture the upside of human ingenuity. Companies expand, innovate, and benefit from productivity gains. Real estate is static—it doesn’t invent the next iPhone or cloud platform.Low Costs & Liquidity

Selling a stock costs almost nothing today. Selling a home? The real estate industry is still an oligopoly which fixes commissions at a ridiculously high level. Expect agent fees, bank fees, taxes, stamp duty, closing costs, and months of waiting.Diversification

Owning a single house ties your wealth to one street in one town. Investing in a global equity index fund spreads it across thousands of companies all over the world.Flexibility & Optionality

Stocks can be reallocated instantly. If one sector struggles, you can pivot to another. Real estate is lumpy and indivisible—you cannot easily sell 5% of your house to rebalance your portfolio.Leverage Cuts Both Ways

Mortgages are a form of leverage and can amplify real estate gains—but also increase risks and magnify losses, as 2008 proved. Getting mortgages can be a costly and long process. Stocks can also easily be leveraged when needed, and, when used, leverage is flexible and scalable.Stocks require less work than real estate.

Real estate demands constant attention—repairs, renovations, tenant turnover, and the occasional neighbour dispute. Stocks, by contrast, can quietly compound in the background for decades through earnings growth and reinvested dividends, requiring little more than patience.

But Isn’t Real Estate “Safer”?

It feels safe only because its price isn’t flashing on a screen every second. The volatility is hidden from view—but becomes painfully real when it’s time to sell. Consider:

2008 showed us that home prices can crash, too.

Mortgages are a form of leverage: they amplify gains but also risks and losses.

One roof replacement or a bad tenant can wipe out years of “returns.”

Over a lifetime, the hidden costs of property ownership can drain more wealth than the stock market’s visible volatility ever could.

Real estate is illiquid: selling a property can take months, and transaction costs are significant, meaning your capital is not readily accessible when you need it.

A Better Way to Think About Your Money

Both assets have a role in a diversified portfolio. But history tells a clear story: over the past 35 years, homes have proven far more reliable as shelter than as a retirement plan.

Stocks, on the other hand, have consistently served as a powerful wealth engine. By steadily investing—even modest amounts—into low-cost index funds, you tap into a century-tested growth machine that has reliably outpaced both inflation and real estate.

What About Rental Properties?

At this point, you might be thinking: “Sure, but what about rental income? Doesn’t property pay for itself?”. On paper, it sounds attractive but, in practice, net rental yields are far lower than most investors expect once all the real costs are factored in.

Take London, one of Europe’s most popular buy-to-let markets.

Typical Gross Rental Yields in London

Overall average: ~4.3% (ONS, 2023)

Prime central London (Mayfair, Knightsbridge): ~2.5–3.0%

Outer boroughs (Zones 3–5): 4.5–5.7%

o Barking & Dagenham: ~6.2%

o Newham: ~5.7%

o Tower Hamlets: ~5.4%

o Greenwich: ~4.8%

o Croydon: ~4.6%

At first glance, a 5–6% yield in some boroughs doesn’t look too bad. But that figure is gross yield—before costs. The reality for landlords looks very different.

From Gross to Net: Where the Money Goes

Gross yield is calculated as annual rent ÷ property price. But to understand your true return, you need to account for expenses. Across the UK, landlords typically spend 35–50% of their rental income on costs such as:

Maintenance and repairs (that new roof doesn’t pay for itself)

Letting agent and management fees

Insurance and compliance costs

Void periods (months without a tenant)

Taxes (including the extra stamp duty surcharge for buy-to-lets)

Once you factor all that in, your net yield usually shrinks to 50–65% of the gross yield.

Academic studies in developed markets (e.g. Case, Shiller, Jordà et al.) often assume ~2.5% net yield for residential property.

Key Takeaway in Plain English

That “4% yield” flat? After costs, you might only pocket 2–2.5% net yield a year. And that’s before you consider the opportunity cost of tying up hundreds of thousands of pounds in a single, illiquid asset.

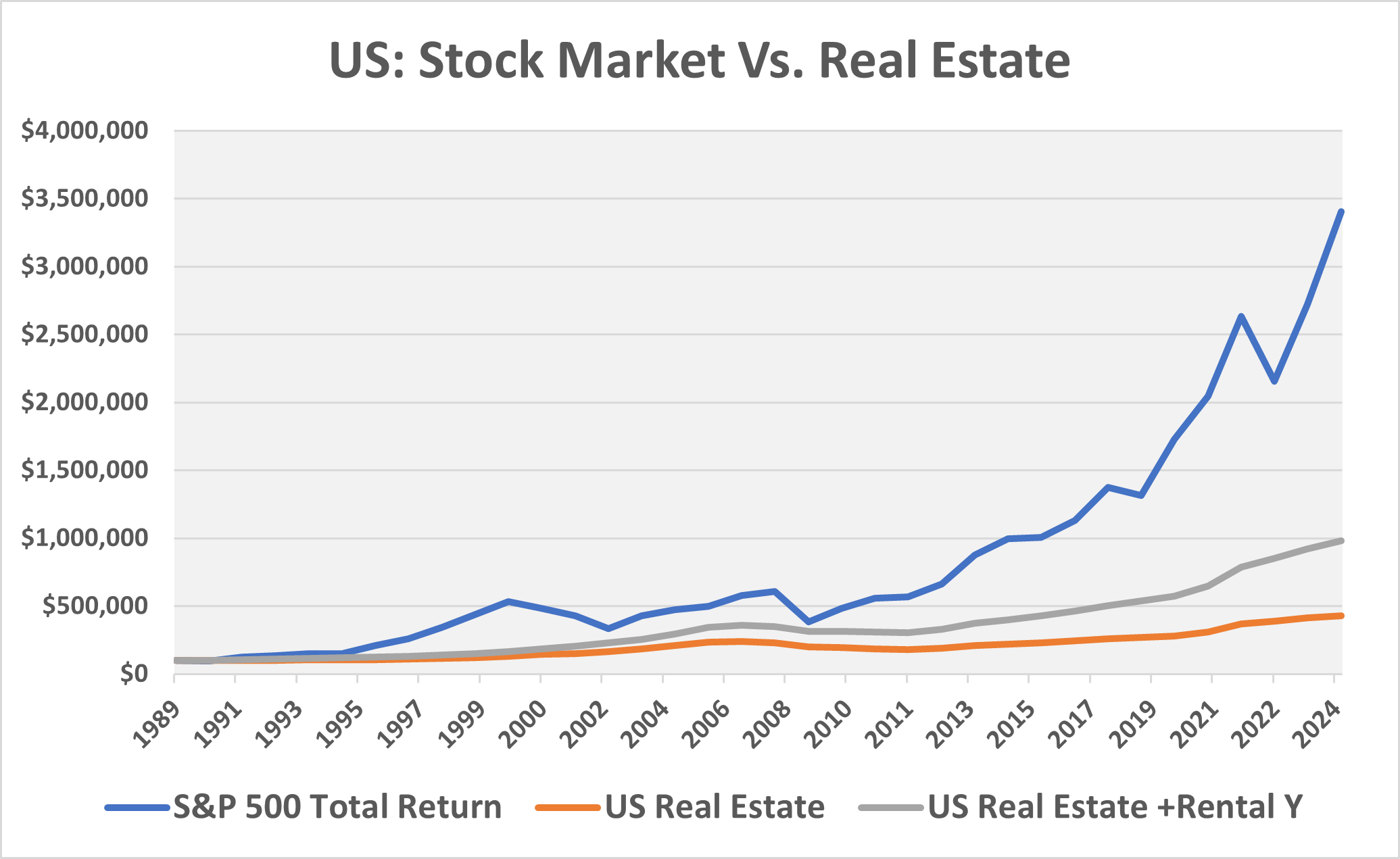

The Striking Charts

If you invested $100,000 in 1990:

In the US stock market, you’d have over $3,400,000 today.

In US housing, you’d have around $430,000.

In a US rental property, you’d have around $980,000.

The table below compares long-term annual returns of the S&P 500 with US real estate, both with and without rental yields, adjusted for inflation.

| S&P 500 TR | US Real Estate | US Real Estate +Rental Y |

Annual Return | 10.6% | 4.2% | 6.7% |

Inflation (CPI avg) | 2.7% | 2.7% | 2.7% |

Approx. Return After Inflation (Real Return) | 7.9% | 1.6% | 4.1% |

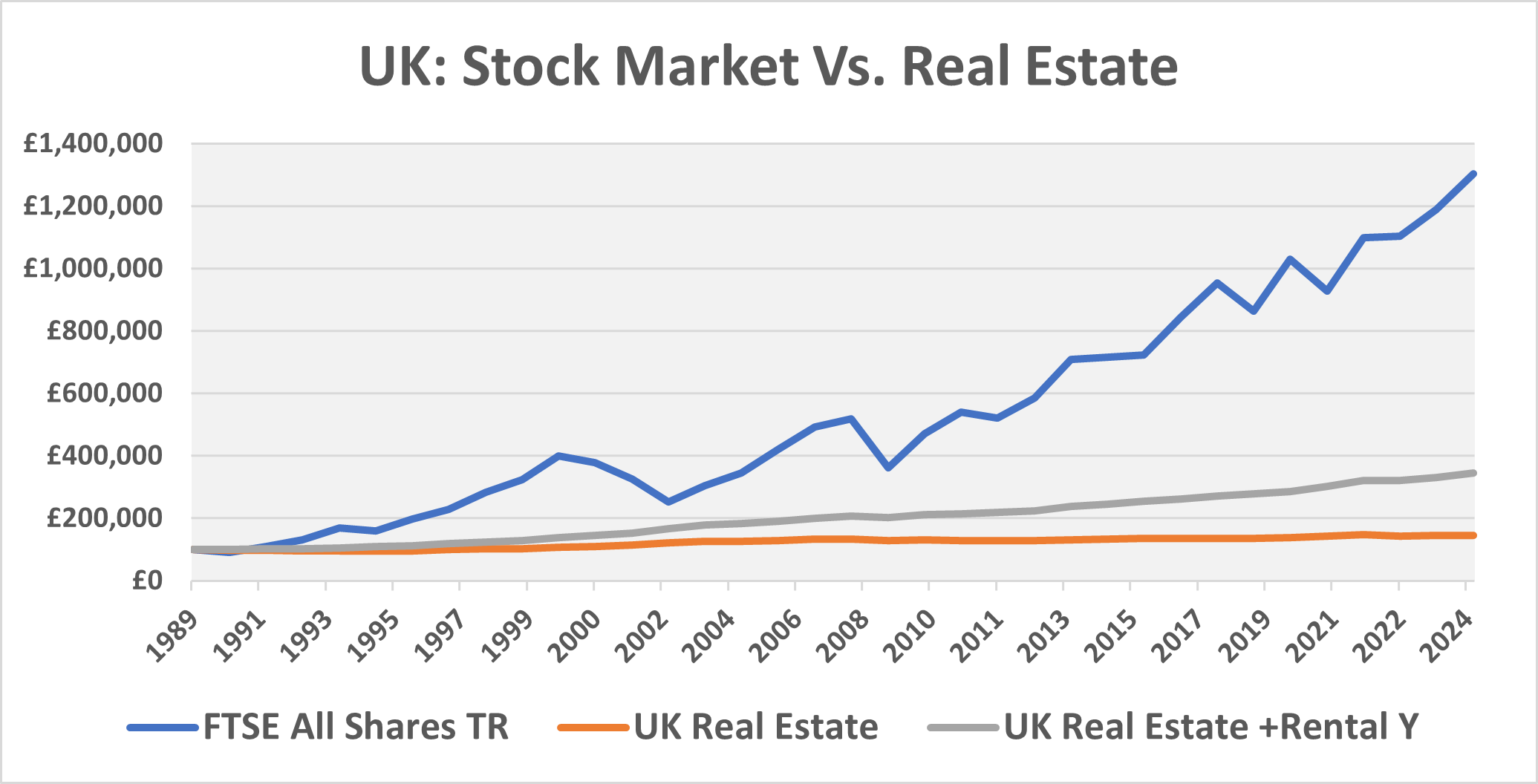

If you invested £100,000 in 1990:

In the UK stock market, you’d have over £1,300,000 today.

In UK housing, you’d have around £146,000.

In a UK rental property, you’d have around £344,000.

The following table shows the long-term returns of UK equities versus UK real estate, with and without rental yields, adjusted for inflation.

| FTSE All Shares TR | UK Real Estate | UK Real Estate +Rental Y |

Annual Return | 7.6% | 1.1% | 3.6% |

Inflation (CPI avg) | 2.7% | 2.7% | 2.7% |

Approx. Return After Inflation (Real Return) | 4.9% | -1.7% | 0.8% |

That’s not just a gap. That’s the difference between retiring comfortably vs. scraping by.

Final Word

This article is not an exhortation to blindly invest in the stock market. Both stocks and houses have a place in a diversified portfolio. A home provides shelter, stability, and emotional value that no spreadsheet can measure. And yes, there are moments when a savvy property investor can find a great deal and come out ahead. But those are exceptions, not the rule. When it comes to building lasting wealth, the evidence is clear: houses offer comfort, while stocks deliver compounding. In short, stocks build wealth; real estate preserves it.

Investing in the stock market is not for everyone. It punishes impatience, panic and impulse buying and selling. It brings volatility and painful drawdowns. Those who invested at the peaks of bubbles, like 1999, were scarred by years of steep losses before recovering. Yet, over the long run, equities have rewarded patience and discipline far more than bricks and mortar.

And today’s markets are more complex than ever. New asset classes like crypto and stablecoins, the rise of options, and shocks even in supposedly “safe” assets, like the bond crash of 2022, prove that opportunities and risks can appear where you least expect it. A disciplined approach to investing, proper diversification and smart risk management are no longer optional: they are survival tools.

For cautious investors, the instinct to prefer the tangible comfort of real estate is understandable. But history shows that comfort can be deceptive: what feels safe can quietly rob you of growth. Stocks, though volatile, harness innovation, productivity, and compounding power in a way real estate cannot.

The most dangerous risk is often the one you don’t see: the silent loss of missed growth. It can be the difference between retiring in comfort and merely getting by.

Sources: Bloomberg

Important Disclaimers: Numbers and illustrations are for educational purposes only and do not represent guarantees of future results. Past performance is not indicative of future returns. This is a marketing communication and does not constitute investment advice. The information and opinions expressed herein are solely those of the author. Investing involves risk - your capital is at risk.

.png)